Coinbase Bitcoin Cash Withdrawal

- Coinbase Bitcoin Cash Withdrawal Limit

- Coinbase Loan

- Coinbase Bitcoin Cash Fork

- Coinbase Atm Withdrawal

- Does Coinbase Support Bitcoin Cash

Instant Card Withdrawals allow eligible Coinbase customers to instantly withdraw money from their fiat wallets directly to their Visa Fast Funds enabled credit and debit cards.

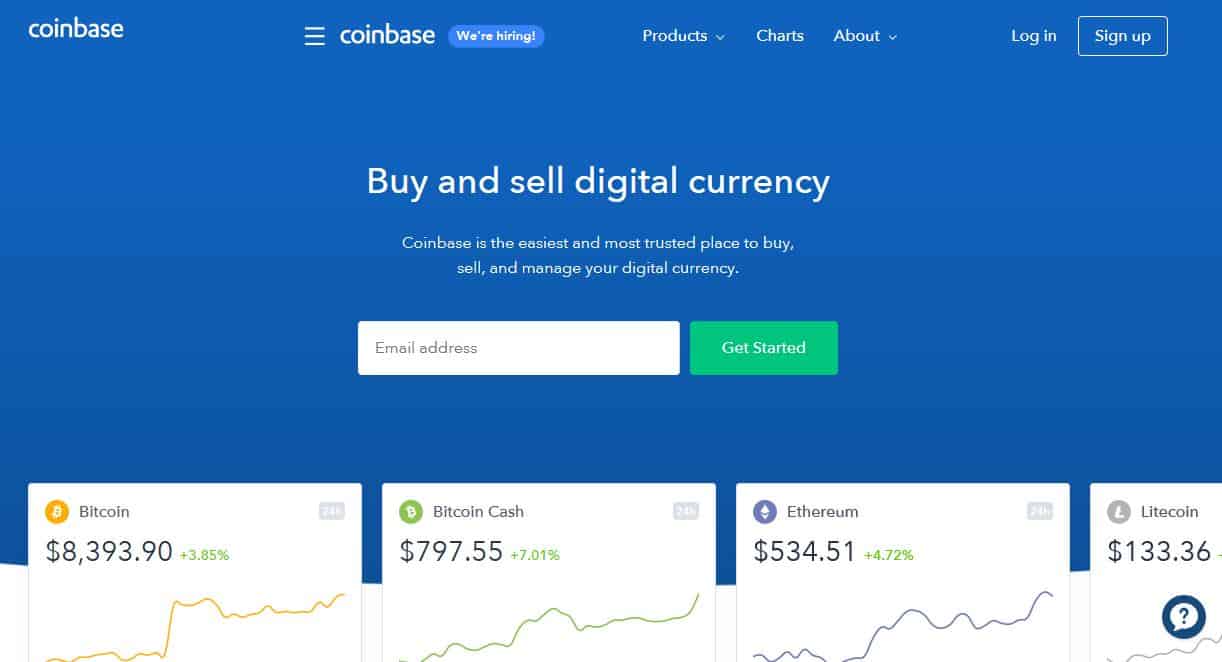

Bitcoin Cash (BCH) is a direct result of a Bitcoin fork that occurred on August 1, 2017. It is an alternative version of Bitcoin that makes use of new features and rules, and has a different development roadmap. This content and any information contained therein is being provided to you for informational purposes only, does not constitute a. Coinbase is a secure platform that makes it easy to buy, sell, and store cryptocurrency like Bitcoin, Ethereum, and more. Based in the USA, Coinbase is available in over 30 countries worldwide.

Please note that US customers can only link Visa Fast Funds or MasterCard Send enabled debit cards (Visa Fast Funds and MasterCard Send are card functionalities that allow real-time transaction processing).

MasterCard withdrawals are not supported for the EU or UK at this time.

Am I eligible?

In order to be eligible for Instant Card Withdrawals, you must:

Live in the UK, EU, or US

Have a verified and linked credit/debit card on Coinbase.com that is Visa Fast Funds or MasterCard Send enabled by your card issuer

Have a GBP, Euro, or USD wallet on Coinbase.com

How does it work?

There are only a few steps to instantly withdraw from your GBP, Euro, or USD wallet.

Ensure you have money in your GBP, Euro, or USD wallet (you may need to sell crypto)

In your GBP, Euro, or USD wallet, select the withdraw button

Choose your linked card from the menu as the withdrawal option

If you don't have any cards linked to your Coinbase account, see these help articles for UK customers, EU customers, and US customers.

How long do Instant Card Withdrawals take?

In most cases your withdrawal will post to your account within 30 minutes, however processing can take up to 24 hours.

Do Instant Card Withdrawals work for all cards?

No, not all card providers allow Instant Card Withdrawals on their platform. If you don't see your card listed as an option, this means your card does not allow this feature. Card eligibility requirements are created by your bank or card provider—please contact them for more information about providing Visa Fast Funds or MasterCard Send for your card.

Are there fees or minimums?

For UK or EU customers:

The Instant Card Withdrawal transaction fee of up to 2% of any transaction and a minimum fee of £0.55 or €0.55.

The minimum withdrawal amount must be greater than the fee of £0.55 or €0.55.

For US customers:

The Instant Card Withdrawal transaction fee of up to 1.5% of any transaction and a minimum fee of $0.55.

Coinbase Bitcoin Cash Withdrawal Limit

The minimum withdrawal amount must be greater than the fee of $0.55.

Can I sell crypto directly to my card?

Coinbase Loan

No, you must first sell your crypto to your GBP, Euro, or USD wallet. After you have money in your GBP, Euro, or USD wallet, you can withdraw to your card.

Coinbase Bitcoin Cash Fork

Are there limits?

There are no Coinbase limits for Instant Card Withdrawals, but your card may have limits. Check with your card provider if you don't know how much you can instantly withdraw to your debit card.

Coinbase Atm Withdrawal

How is my card data secured?

Does Coinbase Support Bitcoin Cash

Card data is securely transferred and hosted off-site by payment vendors. You can read about our data policy here.